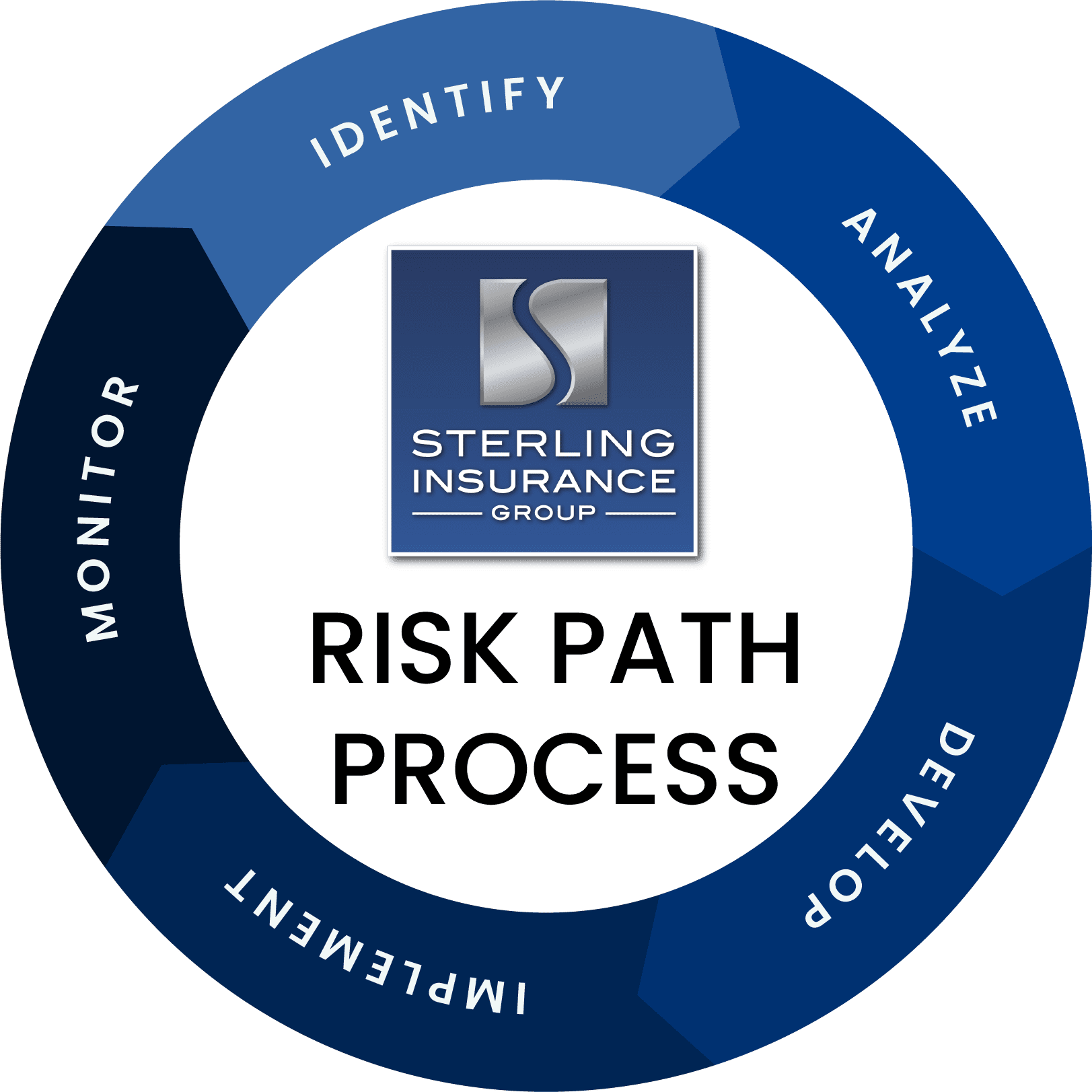

STERLING INSURANCE GROUP RISK PATH PROCESS

Sterling offers a diagnostic and consultative approach for uncovering and mitigating risk for individuals and businesses. It begins with a curiosity and desire to understand the inner workings of a business, otherwise, it is not possible to adequately perform exposure identification.

Sterling utilizes a variety of techniques to identify, measure, and reduce risk while enhancing an organization’s performance through non-insurance solutions. Each decision about how to manage risk is designed to improve your business’ bottom line.

Our consultative approach includes providing Commercial Insurance, Employee Benefits, and Personal Insurance as well as utilizing other risk mitigation tools and services to increase and protect our clients’ profits.